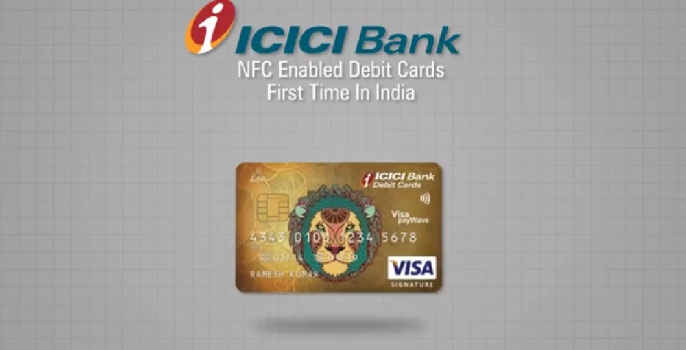

India’s largest private sector bank ICICI became the first bank to launch contactless credit and debit card on 7th January 2015. These cards are based on the near field communication (NFC) technology. Means customers can make eloctronic payments just by waving the cards near the point of sale terminals instead of swiping. The bank’s contactless credit and debit card are named “Coral contactless credit” and “Expression wave debit card”. These are powered by “Master card” and “Visa pay wave” respectively. The cards were initially introduced in Gurgaon, Hyderabad and Mumbai. This facility will expand to other regions verysoon. ICICI bank Expressions wave debit card users will get benefits like complementary access to airport lounges, free accident insurance coverage etc.

Related Post : Twitter based money transfer facility by ICICI bank

Click here for Current Affairs updates

All you should know about contactless credit and debit card

i) The payment cards are based on near field communication (NFC) technology. It uses radio wave frequency for identification. Even these cards can be linked to bluetooth and wireless devices within its range.

ii) Customers will have to tap at point of sale and enter PIN. They don’t have to hand over the card to the merchant or swipe deep into the EDC (Electronic data capture).

iii) With the advent of this card, payment became simpler as verification takes few seconds. There is no fear of getting the card out of your sight.

Risks

Still there are possibility of frauds using free mobile app and data can be stolen by the hackers. Later the stolen identities are used to fulil evil motives. It also increases the risk of eavesdroping attack. Means data can be stolen from a distance as close as 40cm.

However contactless credit and debit cards launched by ICICI come with multiple protection layers. It uses EMV technology to prevent such activities. For transaction the Point of sale terminals have to receive the encrypted private keys. This card is immune to any eavesdropping attack.